Ethereum, the second-largest cryptocurrency by market cap, moved over to proof of stake in an extended-anticipated transition known because the merge. The lengthy and properly-publicized swap to a brand new consensus mechanism made the cryptocurrency way more vitality efficient by eliminating the necessity for miners and changing them with validators who instead stake cryptocurrency and don’t use expensive and power-intensive machines to safe the community.

As we mentioned above, Ethereum is the most decentralized cryptocurrency of our time. GPUs are widely spread everywhere in the world. Plus, you want solely $200-$300 to start mining. After the shift to POS, you’ll need much more investments to begin staking: claim ETHW with a purpose to get a reward, you’ll have to lock the equivalent of $sixty five 000 on your account, not to mention the bills of powering your computer and renting a server to your validator node.

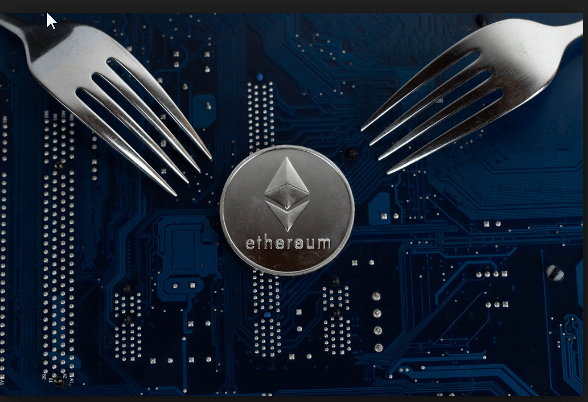

With the Ethereum merge and the complete swap to proof-of-stake, the state of affairs is completely totally different now. An increasing number of miners had to go away the Ethereum network. Above all, a migration to Ethereum Basic was very widespread within the weeks before the merge and likewise had the affect that the Ethereum Traditional worth witnessed a short-term huge value improve a couple of weeks earlier than the merge.

If successful, Ethereum will transfer from a «proof of labor» system — by which power-hungry computer systems validate transactions by fixing advanced mathematical problems — to a «proof of stake» protocol, by which individuals and firms act as validators, utilizing their ether as collateral, in a bid to win recent tokens.